Research Interests:

Household Finance, Financial Inclusion, and Banking

Working Papers:

The Effects of Deleting Medical Debt from Consumer Credit Reports

with Victor Duarte, Julia Fonseca, and Julian Rief (Draft)

Abstract

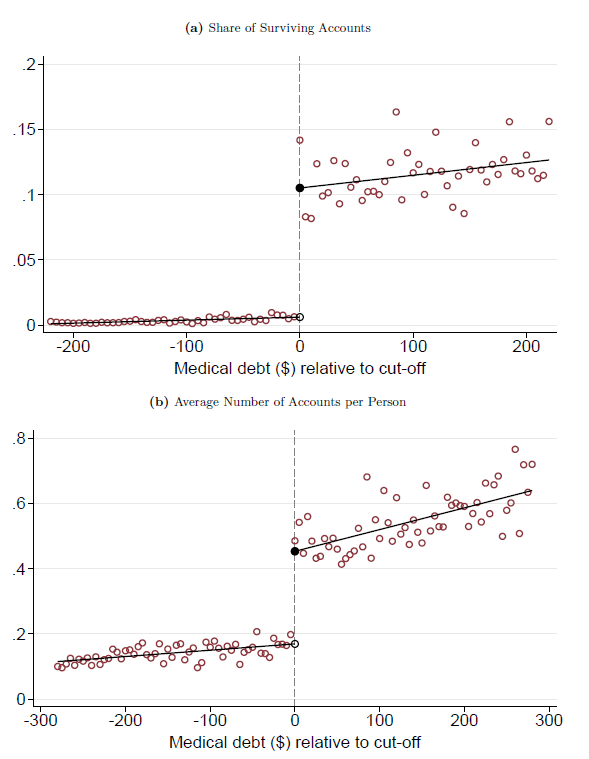

One in seven Americans carry medical debt, with \$88 billion reported on consumer credit reports. In April 2023, the three major credit bureaus stopped reporting medical debts below $500. We study the effects of this information deletion on consumer credit scores, credit limits and utilization, repayment behavior, and payday borrowing. Contrary to expectations that removing this negative credit information would improve credit access for affected individuals, a regression discontinuity analysis comparing individuals above and below the \$500 threshold finds no direct benefits from the information deletion, ruling out small changes. To help interpret these findings, we build credit scoring models using machine learning techniques and show that small medical debts are not meaningfully predictive of defaults, indicating that they contribute little to credit risk assessment. Finally, we show that larger medical debts (≥ $500) are also not meaningfully predictive of default, suggesting that eliminating medical debts entirely from credit reports, as planned under a January 2025 decision by the Consumer Financial Protection Bureau, is unlikely to affect credit outcomes.

Presented at: University of Illinois at Urbana-Champaign, Georgetown McDonough (coauthor)

House of Stolen Cards: Does Payment Security Improve Credit Outcomes for Households?

with Justin Mohr (Draft)

Abstract

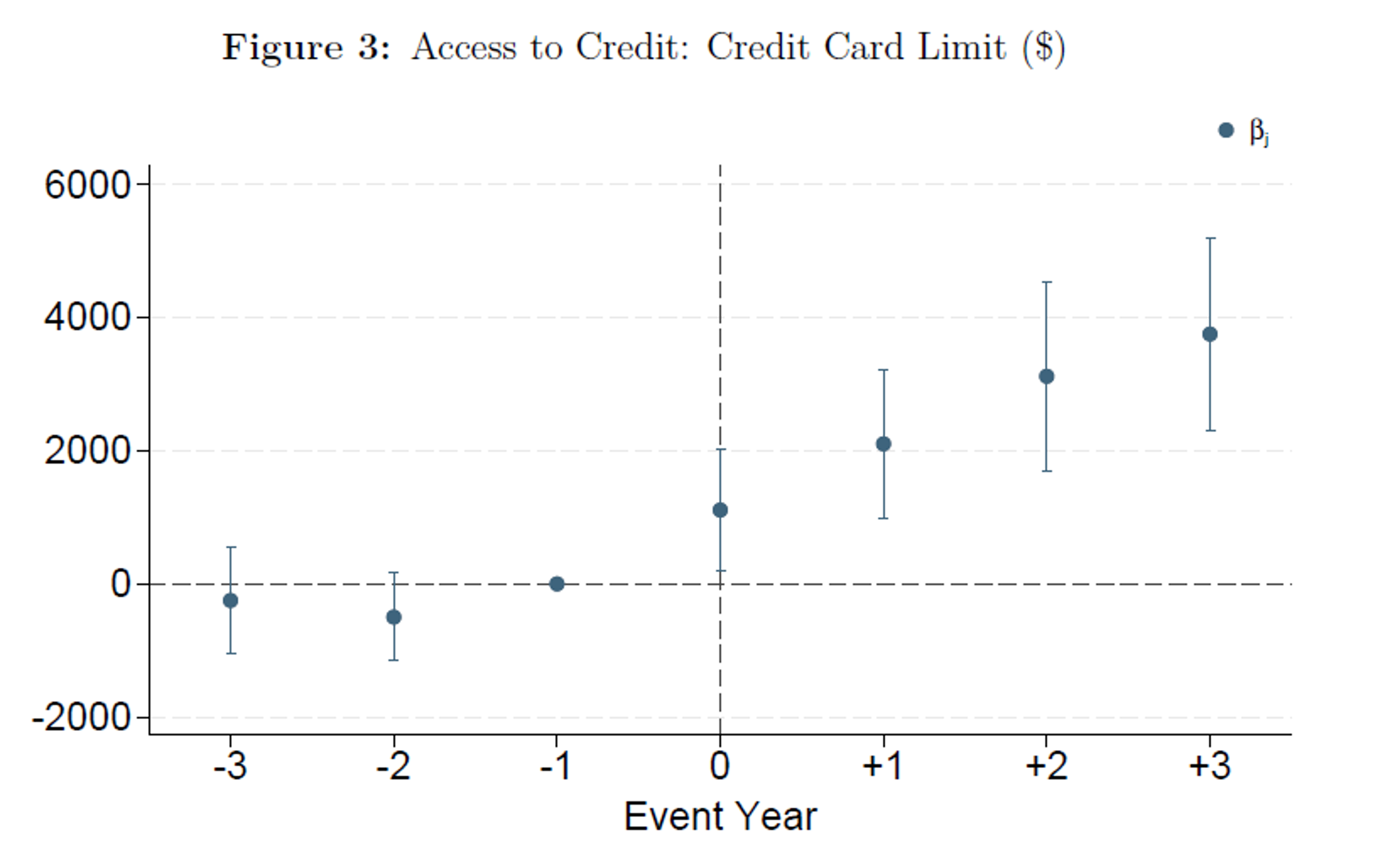

Credit card fraud is the most common type of identity fraud in the U.S., with a cost of over $11.64 billion. In 2014, the U.S. government pushed for widespread adoption of more secure chip-enabled credit cards to safeguard consumers from financial fraud and improve confidence in the marketplace. We study the effects of this technological innovation in payment security on household credit outcomes. Using a matched sample staggered difference-in-differences event study, we show that before this intervention, fraud-exposed consumers faced declines in access to credit. After the innovation, consumers see greater credit availability. We then examine consumer behavior associated with exposure to fraud and find that consumers reduce their credit demand and face increased financial distress. These findings do not change following the innovation. Heterogeneity analysis shows that low-credit-score households are more likely to experience greater declines in credit demand and increased financial distress. Our findings suggest that persistent consumer distrust underscores the need for further policy innovations, such as one-time passcodes for credit card transactions and sufficient financial education for consumers.

Presented at: Financial Management Association 2024 (coauthor), University of Illinois at Urbana-Champaign

Works in Progress:

The Other Half: Monetary Policy Transmission for Households without Mortgages

with Justin Mohr and Yucheng Zhou

Presented at: Financial Management Association Early Ideas 2024